Korean vs Japanese Beauty Philosophy: Which Skincare Approach Actually Works Better?

Table of Contents

- The Great Asian Beauty Divide: Why This Comparison Matters

- Korean Skincare Philosophy: Innovation Meets Intensity

- Japanese Skincare Philosophy: Simplicity and Longevity

- Glass Skin vs Mochi Skin: The Aesthetic Goals

- The Multi-Step Showdown: 10 Steps vs 3 Steps

- Ingredient Battles: Innovation vs Tradition

- Product Categories Compared: What Each Does Best

- Skincare Routine Structures Analyzed

- Scientific Evidence: What Research Actually Shows

- Cost Analysis: Budget Reality Check

- Skin Type Suitability: Which Works for Whom

- Long-Term Results: The 5-Year Perspective

- Cultural Context: Why Philosophy Matters

- Hybrid Approaches: Best of Both Worlds

- The Verdict: Which Philosophy Wins

The Great Asian Beauty Divide: Why This Comparison Matters

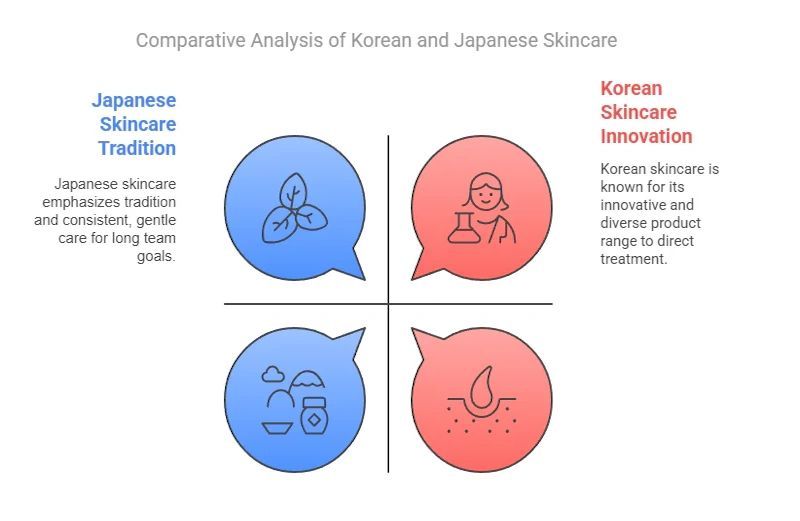

The beauty world witnessed seismic shifts when Asian skincare philosophies exploded onto the global scene, transforming how millions approach daily skin health. Korean K-Beauty captured international imagination with its innovative 10-step routines, sheet mask obsession, and the mesmerizing “glass skin” aesthetic that dominated social media feeds. Japanese J-Beauty quietly commanded respect among dermatologists and skincare purists with minimalist elegance, time-tested ingredients, and the achievable “mochi skin” ideal. By 2026, these competing philosophies have matured, evolved, and created distinct camps of devoted followers each claiming superior results.

The stakes extend beyond marketing hype or Instagram aesthetics. These fundamentally different approaches to skincare represent contrasting relationships with beauty itself - Korean innovation and experimentation versus Japanese refinement and restraint. Understanding which philosophy aligns with your skin needs, lifestyle, and beauty goals determines whether you waste money on trending products or build a genuinely transformative routine backed by science and cultural wisdom spanning generations.

Recent market data reveals Korean cosmetics exports reached $3.61 billion in Q1 2025, positioning Korea as the world’s second-largest cosmetics exporter behind only the United States. This commercial success reflects K-Beauty’s viral appeal and data-backed innovation creating what TikTokers describe as “living in 2050” compared to Western skincare. Meanwhile, Japanese beauty maintains steady growth through premium positioning and reputation for quality, with brands like Shiseido commanding global respect for advanced formulations and rigorous safety testing that exceeds international standards.

The comparison matters deeply in 2026 because both industries continue pushing boundaries in different directions. Korean brands launched PDRN serums, exosome treatments, and AI-personalized formulations that sound like science fiction. Japanese companies perfected fermentation technologies, developed groundbreaking UV filters unavailable in the United States, and refined minimalist routines that challenge the “more products equals better skin” assumption dominating Western beauty culture.

For consumers navigating overwhelming product choices, understanding these philosophical differences prevents costly mistakes and frustrating trial-and-error. The Korean approach works brilliantly for some skin types and personalities while proving overwhelming or irritating for others. Japanese minimalism delivers long-term results for patient users committed to prevention but may disappoint those seeking immediate transformation. This comprehensive comparison examines both philosophies through scientific evidence, ingredient analysis, real-world results, and practical considerations including budget, time investment, and skin type compatibility.

The regulatory landscape also affects product safety and efficacy in ways consumers should understand. While both countries maintain rigorous cosmetic standards, approaches differ significantly. According to FDA cosmetics regulations, United States cosmetics require no pre-market approval except color additives, creating potential safety gaps that Asian markets address through more comprehensive oversight. Japanese quasi-drugs undergo approval processes ensuring clinical efficacy, while Korean regulations mandate safety assessments and ingredient restrictions protecting consumers from harmful substances.

Korean Skincare Philosophy: Innovation Meets Intensity

Korean skincare philosophy centers on prevention, perfection, and perpetual innovation, creating beauty culture where skin health represents personal discipline and social presentation. The approach emerged from Korean beauty standards emphasizing flawless complexion as crucial to professional success and social acceptance, driving intense cultural pressure to maintain perfect skin through dedicated daily routines. This cultural context birthed the multi-step methodology, constant ingredient innovation, and focus on immediate visible results that define K-Beauty globally.

The foundation rests on several core principles that differentiate Korean skincare from competing philosophies. First, prevention supersedes correction - rather than treating skin problems after they appear, Korean philosophy emphasizes protecting and maintaining skin health through daily vigilance. This explains the Korean obsession with sunscreen application, environmental protection, and barrier care long before Western beauty culture recognized their importance. Second, hydration forms the cornerstone of healthy skin, leading to the famous “7 skin method” layering multiple toner applications and the essence category that barely existed in Western skincare until Korean products popularized the concept.

Third, innovation drives constant product evolution with Korean brands launching new ingredients, formulations, and technologies at breathtaking pace. The country’s competitive domestic market with retailers like Olive Young creating pressure for brands to differentiate through genuine innovation rather than marketing alone. This produced breakthroughs including BB creams, cushion compacts, sleeping masks, and ingredients like snail mucin, bee venom, and fermented galactomyces that initially seemed bizarre to Western consumers but delivered proven results.

Fourth, customization allows individuals to build personalized routines addressing specific concerns rather than following one-size-fits-all approaches. The modular structure of Korean routines permits mixing and matching products from different brands, adjusting step count based on skin needs, and responding to changing conditions seasonally or environmentally. This flexibility appeals to beauty enthusiasts who enjoy researching ingredients and experimenting with combinations.

The 2026 Korean beauty landscape shifted toward what industry insiders call “intelligent minimalism” - fewer steps with more sophisticated multi-functional products replacing the previous emphasis on maximum layering. Olive Young’s trend report identified “slow aging” as the dominant philosophy, focusing on barrier repair and resilient skin rather than aggressive anti-aging interventions. PDRN serums utilizing salmon DNA for regenerative benefits exploded in popularity, alongside exosome treatments and hybrid products blurring lines between skincare and makeup.

Korean dermatologists increasingly emphasize gentle, consistent care supporting skin health rather than harsh treatments promising quick fixes. This evolution reflects maturation of K-Beauty from trend-driven novelty to evidence-based skincare incorporating dermatological wisdom. However, the fundamental Korean approach maintains its characteristic intensity - even “simplified” Korean routines typically involve 5-7 steps compared to Western 2-3 step basics.

The sensorial dimension of Korean skincare deliberately enhances user experience beyond clinical efficacy. Products feature luxurious textures transforming from gel to water, innovative delivery systems, pleasant fragrances, and satisfying application experiences that make multi-step routines feel like self-care rituals rather than chores. TikTok’s sensory skincare trend amplified this aspect, with Korean brands creating viral moments through “oddly satisfying” textures and dramatic before-after transformations.

Korean innovation extends beyond facial skincare into emerging categories. K-Beauty hair care surged in 2026 with scalp-focused treatments, lightweight serums, and technology-driven solutions addressing hair health from root to tip. The industry also expanded “inner beauty” through ingestible skincare supplements targeting skin, hair, and stress from inside out, reflecting holistic wellness philosophy linking diet, lifestyle, and appearance.

Japanese Skincare Philosophy: Simplicity and Longevity

Japanese skincare philosophy embodies the concept of “kirei” - clean, pure, and beautiful - prioritizing natural harmony, minimal intervention, and long-term skin health over immediate transformation. The approach emerged from centuries of beauty tradition including geisha practices, traditional herbal medicine, and cultural values emphasizing quality over quantity, patience over haste, and refinement over excess. This philosophical foundation created skincare culture where fewer products applied correctly outperform extensive routines executed carelessly.

The core principles defining J-Beauty center on respecting skin’s natural functions rather than overwhelming them with excessive intervention. Japanese philosophy views skin as living organ requiring gentle support to maintain its inherent wisdom, contrasting sharply with Western approaches often treating skin as problem requiring aggressive correction. This manifests in pH-balanced formulations matching skin’s natural acidity, minimal ingredient lists avoiding potential irritants, and gentle textures supporting rather than stripping the skin barrier.

Japanese skincare emphasizes long-term prevention through daily sunscreen use, consistent hydration, and barrier protection preventing damage before it requires treatment. The philosophy accepts that visible results require patience and consistent application over weeks or months, contrasting with Korean and Western pressure for immediate transformation. This long-term thinking resonates with Japanese cultural values of dedication, discipline, and delayed gratification producing superior outcomes compared to quick fixes.

The “less is more” principle permeates J-Beauty at every level, from product formulations using carefully selected ingredients to streamlined routines focusing on essential steps executed perfectly. Japanese brands invest heavily in refining individual products rather than launching constant novelties, with some formulations remaining unchanged for decades because they work effectively. This contrasts dramatically with Korean constant innovation and Western trend cycles demanding newness regardless of whether improvements actually occur.

Quality consciousness drives Japanese skincare toward premium positioning, with brands prioritizing ingredient purity, advanced manufacturing processes, and elegant packaging reflecting product excellence. Even affordable Japanese brands like Hada Labo maintain quality standards that shame many Western prestige products. This quality focus explains why Japanese skincare commands higher prices globally - consumers pay for genuinely superior formulations, not just marketing and branding.

The holistic approach connects skincare with overall wellness, diet, stress management, and lifestyle factors affecting skin health. Japanese beauty culture recognizes that topical products alone cannot create truly beautiful skin without supporting internal health through proper nutrition, adequate sleep, and stress reduction. This philosophy manifested in 2026 trends emphasizing “beauty from within” through functional skincare supplements and integration of skincare with broader wellness practices.

Japanese innovation occurs through refinement rather than revolution, perfecting existing technologies and ingredients rather than constantly chasing novelty. Japanese brands pioneered advanced UV filter technology creating sunscreens that feel invisible on skin while providing superior broad-spectrum protection. They mastered fermentation processes creating potent ingredients with enhanced bioavailability and skin benefits. They developed encapsulation technologies delivering active ingredients more effectively with less irritation.

The traditional ingredient focus showcases Japanese commitment to time-tested botanicals proven safe and effective over generations. Rice bran for brightening and nourishing, green tea for antioxidant protection, camellia oil for hydration, yuzu for vitamin C, and seaweed for minerals represent ingredients used in Japanese beauty rituals for centuries now validated by modern science. This bridges ancient wisdom with contemporary dermatology, creating products rooted in cultural heritage while meeting scientific standards.

Japanese skincare routines emphasize technique and application method equally with product selection. Facial massage during application enhances circulation and product absorption. Gentle patting rather than rubbing respects delicate facial skin. Layering thin product layers maximizes absorption while heavy application wastes product and potentially clogs pores. These techniques transform simple routines into meditative self-care rituals providing psychological benefits alongside skin improvements.

The 2026 Japanese beauty landscape maintained its core philosophy while incorporating selective innovations. “Skinimalism” remains defining principle with consumers investing in fewer, higher-quality multifunctional products rather than extensive collections. Clean beauty formulations avoiding harsh chemicals, parabens, and synthetic fragrances gained prominence alongside sustainable packaging and ethically sourced ingredients reflecting environmental consciousness. Advanced diagnostic tools and AI-personalized formulations entered the market, though always within J-Beauty’s minimalist framework prioritizing simplicity over complexity.

Glass Skin vs Mochi Skin: The Aesthetic Goals

The aesthetic ideals pursued by Korean and Japanese skincare philosophies reveal fundamental differences in beauty standards and achievability. Korean “glass skin” describes complexion appearing smooth, poreless, and translucent like polished glass - skin so luminous it seems to reflect light with mirror-like quality. This extreme ideal demands perfect skin texture, complete pore minimization, intense hydration creating plumpness, and strategic highlighting creating dimensional glow. The look dominated social media through 2024-2025 with countless tutorials demonstrating multi-step routines and strategic product layering required to achieve the effect.

Glass skin requires extensive preparation including multiple hydrating toner layers, essence applications, targeted serums, and highlighting products creating the characteristic sheen. The routine emphasizes ceramides, hyaluronic acid, and niacinamide building skin plumpness while minimizing texture irregularities. Exfoliation removes dead skin creating smooth canvas, while strategic use of illuminating products enhances natural skin luminosity. The result photographs beautifully, creating the viral moments that propelled glass skin into global beauty consciousness.

However, glass skin presents significant challenges for real-world achievement and maintenance. The look requires near-perfect lighting conditions, specific camera angles, and often photographic filters enhancing the effect beyond natural appearance. Skin texture, enlarged pores, fine lines, and natural skin variations make true glass skin unattainable for most people regardless of routine intensity. The pursuit can encourage unhealthy perfectionism and product overuse potentially compromising skin barrier health through excessive layering or harsh treatments forcing pore minimization.

Japanese “mochi skin” draws inspiration from the traditional rice cake’s soft, bouncy, slightly translucent texture - skin appearing plump, supple, and resilient with natural healthy glow. Rather than reflective perfection, mochi skin emphasizes skin that feels wonderful to touch, bounces back when pressed, and radiates health from proper hydration and barrier function. The aesthetic accepts natural skin texture, visible pores, and individual variations while celebrating skin’s inherent beauty through optimal health.

Mochi skin proves more achievable for diverse skin types and ages because it focuses on skin health rather than perfect appearance. The goal centers on adequate hydration creating skin plumpness, strong barrier function maintaining moisture, and gentle care preserving skin’s natural bounce and resilience. Products emphasize ceramides supporting barrier repair, hyaluronic acid providing deep hydration, and fermented ingredients enhancing skin’s natural functions. The result feels luxurious and appears healthy without requiring extensive product layering or perfect lighting.

The practical difference between these aesthetics significantly impacts daily routine complexity and long-term sustainability. Glass skin demands constant maintenance, extensive morning and evening routines, and careful product selection maintaining the intensive hydration and glow. The high-maintenance nature can lead to routine burnout, product fatigue, and potential skin issues from excessive layering. Mochi skin requires consistent basic care but forgives occasional lapses and doesn’t demand perfection for maintaining healthy appearance.

From dermatological perspective, mochi skin aligns better with actual skin health markers. Skin that feels bouncy and resilient indicates adequate hydration, strong barrier function, and good collagen support - all genuine health indicators. Glass skin’s extreme poreless appearance may require pore-minimizing products or treatments potentially irritating sensitive skin or disrupting normal sebum production necessary for skin health. The focus on reflective luminosity sometimes comes from product buildup or excessive oils rather than true skin radiance.

Both aesthetics influenced global beauty standards in different ways. Glass skin inspired Western consumers to prioritize hydration and glow, moving away from matte makeup finishes dominating previous decades. Mochi skin introduced the concept that skin texture and bounce matter as much as visual appearance, encouraging focus on how skin feels alongside how it looks. Together they shifted beauty culture toward celebrating skin health and natural luminosity over heavy coverage and artificial perfection.

The 2026 evolution saw both aesthetics become more nuanced and realistic. “Glass skin” transitioned toward “glazed skin” or “honey skin” - less extreme versions maintaining luminosity without requiring impossible poreless perfection. Mochi skin expanded into broader wellness conversations about skin resilience, barrier health, and age-appropriate beauty celebrating skin at every life stage. These evolutions reflect maturation of both Korean and Japanese beauty philosophies toward sustainable, health-focused approaches rather than unattainable ideals.

The Multi-Step Showdown: 10 Steps vs 3 Steps

The step count debate crystallizes practical differences between Korean and Japanese skincare philosophies, though the reality proves more nuanced than simple number comparison. Korean skincare gained fame through the “10-step routine” that initially shocked Western consumers accustomed to cleanse-moisturize-SPF basics. The comprehensive approach typically includes oil cleanser, water-based cleanser, exfoliator, toner, essence, serum, sheet mask, eye cream, moisturizer, and sunscreen - though not all steps occur daily and individual routines vary significantly based on skin needs and available time.

The Korean multi-step philosophy operates on the principle that each product serves specific function impossible to achieve through multi-tasking formulations. Oil cleansers remove makeup and sunscreen, water-based cleansers clean skin, exfoliators remove dead cells, toners prep skin for subsequent products, essences provide lightweight hydration, serums deliver concentrated actives targeting specific concerns, moisturizers seal everything in, and sunscreen protects from UV damage. This modular approach allows customization addressing individual skin issues while maintaining comprehensive care.

However, the 10-step routine faces legitimate criticisms regarding necessity, time commitment, and potential for over-exfoliation or product overload. Dermatologists note that excessive layering can overwhelm skin’s natural functions, disrupt barrier health, and waste money on redundant products. The time investment proves unsustainable for busy lifestyles, leading to inconsistent application undermining routine effectiveness. Product interactions between multiple formulations can reduce efficacy or cause unexpected reactions as ingredients combine unpredictably.

The 2026 Korean shift toward “intelligent minimalism” reduced step counts while maintaining philosophy of targeted treatments. Modern Korean routines average 5-7 steps focusing on multi-functional products delivering multiple benefits rather than single-purpose formulations. Hybrid products like essence toners, serum moisturizers, and tinted sunscreens consolidate steps without sacrificing benefits. This evolution acknowledges that previous extensive routines sometimes reflected beauty industry marketing more than actual skin needs.

Japanese skincare traditionally emphasized 3-5 step routines centering on essential functions: thorough cleansing, hydration, and protection. The basic structure includes double cleansing (oil then foam), hydrating lotion or essence, serum addressing specific concerns, moisturizer, and sunscreen. This streamlined approach focuses on perfect execution of fundamental steps rather than adding layers for their own sake. Each product in Japanese routines typically contains higher concentration of active ingredients and more sophisticated formulation allowing one product to achieve what multiple Korean products might require.

The Japanese philosophy argues that quality trumps quantity - fewer products applied correctly with proper technique deliver better results than extensive layering executed carelessly. This resonates with minimalist lifestyle trends and appeals to consumers overwhelmed by decision fatigue from endless product choices. The simplified routine proves easier to maintain consistently over years and decades, which Japanese philosophy values highly for long-term skin health.

Practical comparison reveals both approaches can work effectively when properly implemented. Korean multi-step routines excel for people who enjoy skincare as hobby, have specific complex skin concerns requiring targeted treatments, and find satisfaction in comprehensive self-care rituals. The customization allows addressing multiple issues simultaneously while the step-by-step process provides meditative benefits reducing stress. For combination skin with different needs across facial zones, multiple products enable zone-specific treatment impossible with single product.

Japanese minimal routines suit busy lifestyles, travel-heavy schedules, and personalities preferring simplicity over complexity. The streamlined approach reduces decision fatigue, limits exposure to potential irritants, and costs less money over time despite higher per-product pricing. For people with generally healthy skin requiring maintenance rather than correction, minimal routine provides everything necessary without waste. Sensitive skin often benefits from fewer products reducing cumulative irritation risk.

The hybrid middle ground combines both philosophies’ strengths. Use Japanese double cleansing method ensuring thorough makeup removal. Apply Korean essence and serum targeting specific concerns. Finish with Japanese quality moisturizer and superior sunscreen. This creates 5-6 step routine leveraging each culture’s innovations while maintaining reasonable time commitment and product load.

Research examining routine effectiveness shows step count matters less than consistency, appropriate product selection for skin type, and proper application technique. A 3-step routine followed daily for years outperforms 10-step routine applied sporadically or incorrectly. Ingredient quality and formulation sophistication matter more than sheer product quantity. Sunscreen application represents the single most impactful step regardless of overall routine complexity.

Ingredient Battles: Innovation vs Tradition

The ingredient philosophies separating Korean and Japanese skincare reveal contrasting approaches to beauty innovation and consumer trust. Korean brands aggressively pursue novel ingredients regardless of traditional use, betting on scientific validation and consumer curiosity about cutting-edge actives. This produced ingredients that initially seemed outlandish but proved effective through clinical testing and user experience. Snail mucin for hydration and healing, bee venom for anti-inflammatory benefits, pig collagen for skin plumping, and fermented galactomyces for brightening entered mainstream consciousness through Korean products willing to explore unconventional sources.

The Korean ingredient innovation cycle moves rapidly, with new actives appearing constantly as brands differentiate through unique formulations. PDRN (polydeoxyribonucleotide) derived from salmon DNA emerged as 2024-2025 breakthrough ingredient for regenerative benefits and wound healing, now mainstream in Korean serums and professional treatments. Exosomes from various sources promise cell-to-cell communication benefits. Growth factors, stem cell extracts, and biomimetic peptides represent cutting-edge actives Korean brands commercialize ahead of Western counterparts.

Korean formulations typically use higher concentrations of active ingredients compared to Japanese or Western products, gambling that consumers want maximum potency even if it increases irritation risk for sensitive skin. This appeals to beauty enthusiasts wanting fastest possible results and willing to accept potential side effects. The approach works well for resilient skin but can overwhelm sensitive or compromised barriers requiring gentler introduction of actives.

However, Korean ingredient innovation sometimes prioritizes novelty over necessity, creating marketing differentiation rather than meaningful skin benefits. Ingredients without substantial clinical evidence appear in products based on preliminary research or theoretical benefits, potentially disappointing consumers expecting dramatic results. The rapid cycle also means long-term safety data may be limited for newest ingredients, though Korean safety regulations require basic testing before market entry.

Japanese ingredient philosophy emphasizes time-tested botanicals used in traditional beauty rituals for generations, now validated through modern scientific research. Rice bran containing gamma-oryzanol, ferulic acid, and vitamin E provides brightening and antioxidant benefits proven through centuries of use and recent clinical studies. Green tea polyphenols deliver potent antioxidant protection. Camellia oil rich in oleic acid and antioxidants nourishes skin without heaviness. These ingredients offer comfort of extensive historical use alongside scientific validation.

Japanese innovation occurs through advanced processing of traditional ingredients rather than constantly seeking novel sources. Fermentation technology enhances ingredient bioavailability and creates additional beneficial compounds. Encapsulation methods deliver actives more effectively to target skin layers. Extraction techniques maximize active compound concentration while minimizing irritants. This creates products feeling modern and scientifically sophisticated while maintaining connection to cultural heritage.

Japanese formulations prioritize purity, with minimal ingredient lists avoiding potential irritants, fragrances, and dyes unless specifically necessary for product function. This aligns with the philosophy that skin works best when not overwhelmed by excessive ingredients. The approach appeals to sensitive skin and consumers wary of complicated formulations with unknown interactions between multiple actives. However, it can limit options for people with specific concerns requiring targeted treatment with multiple actives.

The safety and efficacy standards differ significantly between countries. Japan’s pharmaceutical-level regulation for quasi-drugs ensures products making specific claims meet efficacy standards through clinical testing. Korean regulations require safety assessment but allow more flexible claims based on ingredient properties rather than finished product testing. Understanding these differences helps consumers evaluate product promises and ingredient credibility. According to FDA authority over cosmetics, United States cosmetics face less stringent pre-market requirements than either Asian country.

Specific ingredient comparisons reveal each culture’s strengths. For hydration, Korean brands excel in hyaluronic acid serums with multiple molecular weights penetrating different skin layers, while Japanese brands perfected elegant textures making hydrating lotions feel weightless despite rich hydration. For brightening, Korean vitamin C and niacinamide concentrations often exceed Japanese formulations, though Japanese arbutin and tranexamic acid products show superior stability and gentleness. For anti-aging, Korean peptide and retinoid products provide potency while Japanese collagen-supporting formulations offer long-term structural benefits.

The fermentation category showcases both cultures’ expertise. Korean brands popularized fermented galactomyces and saccharomyces delivering brightening and anti-aging benefits. Japanese sake kasu (rice fermentation by-product) and soy ferments represent traditional ingredients now produced through modern biotechnology. Both approaches create products with enhanced penetration, bioavailability, and additional beneficial compounds generated through fermentation process.

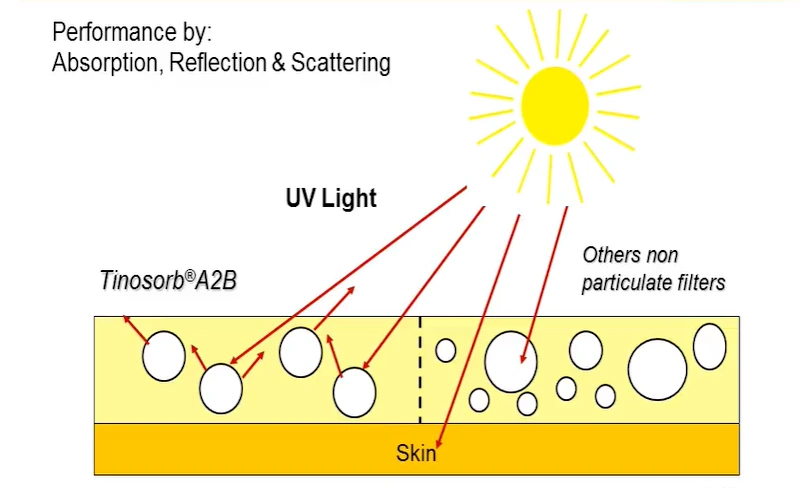

Sunscreen ingredients dramatically demonstrate Japanese technical superiority. Japanese UV filters like Tinosorb S, Uvinul A Plus, and new-generation Parsol Max provide broad-spectrum protection with elegant cosmetic feel unavailable in United States products constrained by FDA’s slow approval process for new sunscreen actives. Korean sunscreens use similar filters (often licensed from Japanese manufacturers) but excel in hybrid formulations combining sun protection with skincare benefits and user-friendly application encouraging consistent use.

For consumers building effective routines, combining both ingredient philosophies offers optimal results. Use Korean innovation for targeted treatment products addressing specific concerns. Choose Japanese quality for daily essentials like cleansers and sunscreens requiring gentle efficacy and consistent use. Consider ingredient concentration, skin sensitivity, and specific goals when selecting between high-potency Korean formulations and gentler Japanese alternatives.

Product Categories Compared: What Each Does Best

Examining specific product categories reveals where Korean and Japanese philosophies excel, helping consumers choose best options for each routine step. Understanding these strengths enables building hybrid routines leveraging each culture’s innovations while avoiding weaknesses.

Cleansers demonstrate Japanese technical superiority through pH-balanced formulations and gentle surfactants maintaining skin’s natural acidity while removing impurities effectively. Japanese cleansers rarely leave skin feeling tight or stripped, instead leaving soft, clean feeling without disrupting barrier function. Brands like Hada Labo, Senka, and Shiseido perfected low-pH cleansing foams and cream cleansers that work for even sensitive skin. Korean cleansers offer wider variety including innovative textures like sherbet balms, cushion gels, and transforming formulations, though sometimes prioritize sensorial experience over optimal pH.

The double cleansing method originated in Japanese beauty culture and remains best executed with Japanese oil cleansers. Products like DHC Deep Cleansing Oil and Shu Uemura cleansing oils melt away makeup effortlessly without leaving residue or requiring harsh rubbing. Korean cleansing balms and oils offer similar efficacy with more fragrant, luxurious experiences and innovative packaging, though purists prefer Japanese unfragranced efficiency.

Toners reveal the starkest category difference. Japanese “lotions” (actually hydrating toners) like Hada Labo Gokujyun Premium provide intense hydration with minimal ingredients in watery texture absorbing instantly. Korean toners divide into multiple subcategories: essence toners delivering active ingredients, pH-adjusting toners preparing skin for acids, and ferment-based toners like SK-II’s Treatment Essence (actually Japanese despite Korean competition). Korean variety offers more choice but can confuse newcomers unsure which type their routine requires.

Essences represent Korean innovation at its finest. The lightweight watery serums concentrating active ingredients in highly absorbable format barely existed in Western skincare before K-Beauty popularization. Products like COSRX Advanced Snail 96 Mucin Power Essence and Missha Time Revolution First Treatment Essence deliver potent actives without heaviness. Japanese versions tend toward simple hydration while Korean essences provide targeted treatment for brightening, anti-aging, or barrier repair.

Serums showcase both cultures’ strengths. Korean serums offer highest active concentrations, widest ingredient variety, and targeted formulations addressing every possible concern from hyperpigmentation to pore minimization. Japanese serums prioritize stability, elegant textures, and gentle efficacy suitable for daily use without irritation risk. For aggressive treatment, choose Korean potency. For consistent long-term use, select Japanese refinement.

Moisturizers demonstrate Japanese mastery of texture and penetration. Products absorb fully without residue, provide lasting hydration without greasiness, and layer beautifully under sunscreen and makeup. Korean moisturizers often emphasize cooling sensations, trendy ingredients, and Instagram-worthy packaging, though performance varies more widely by brand. Japanese moisturizer consistency proves more reliable across price points.

Sunscreen represents Japan’s crowning achievement in skincare innovation. Japanese sunscreens feel invisible on skin, layer perfectly with makeup, reapply without disrupting foundation, and provide superior broad-spectrum protection through advanced UV filters. Brands like Biore, Anessa, Allie, and Skin Aqua created products so elegant they transformed sunscreen from dreaded obligation to pleasurable routine step. Korean sunscreens match efficacy using licensed Japanese filters but excel in hybrid formulations combining SPF with skincare benefits, tinted options, and social media-friendly application making sun protection more accessible to younger users.

Sheet masks exemplify Korean creativity and market dominance. The category barely existed before Korean brands made sheet masks essential skincare staple available in thousands of varieties targeting every possible concern. Japanese sheet masks tend toward simple hydration with higher-quality materials, while Korean versions pack maximum ingredients into affordable price points encouraging frequent use. For variety and experimentation, Korean masks win decisively. For luxury experience, Japanese biocellulose or hydrogel masks provide superior.

Eye creams show Japanese understanding of delicate eye area needs. Products deliver targeted treatment without migrating, causing puffiness, or interfering with makeup application. Korean eye patches and targeted treatments offer quick fixes for specific issues, while Japanese formulations provide consistent long-term care preventing premature aging.

Sleeping masks represent Korean innovation creating overnight treatment category. Thick creams or gel masks sealing in earlier products while delivering additional active ingredients during skin’s nighttime repair cycle. The format proves particularly useful for dry climates or heavily air-conditioned environments. Japanese nighttime care focuses more on traditional moisturizers rather than specific sleeping mask format.

Exfoliators demonstrate different philosophical approaches. Korean exfoliation emphasizes gentle daily peeling pads, mild AHA/BHA toners, and enzymatic formulations allowing frequent use without over-exfoliation. Japanese physical exfoliators using gentle scrubbing grains or peeling gels rely on less frequent application. Korean approach suits oily skin benefiting from regular exfoliation while Japanese method protects sensitive skin from irritation through minimal intervention.

For specialized treatments like acne, hyperpigmentation, or anti-aging, Korean innovation provides more options with higher active concentrations. Retinol products, high-strength vitamin C serums, and targeted spot treatments appear more frequently in Korean lineups. However, Japanese quasi-drugs backed by pharmaceutical-level efficacy testing offer medically-recognized benefits for specific concerns, providing assurance beyond cosmetic claims. Understanding whether you need harmful chemicals legal products helps navigate ingredient safety across both markets.

Skincare Routine Structures Analyzed

The daily routine structures embody philosophical differences between Korean comprehensiveness and Japanese essentialism. Examining morning and evening routines reveals how these approaches manifest practically in time investment, product usage, and expected results.

Korean morning routine typically begins with gentle foam cleanser removing overnight oil production and skincare residue. Next comes toner rebalancing skin pH and providing first hydration layer. Essence follows delivering concentrated actives in lightweight formula. Targeted serum addresses specific concerns like dark spots, fine lines, or redness. Eye cream prevents signs of aging in delicate orbital area. Lightweight morning moisturizer hydrates without heaviness. Final step applies generous sunscreen protecting from UV damage throughout day. This 7-step process requires approximately 10-15 minutes depending on product absorption time and application technique.

Korean evening routine escalates significantly with double cleansing starting the process. Oil cleanser removes makeup, sunscreen, and oil-based impurities through gentle massage. Water-based foam cleanser eliminates remaining dirt and residue. Exfoliator appears 2-3 times weekly removing dead skin cells. Toner prepares skin for maximum absorption. Essence delivers active ingredients. Targeted serum or ampoule treats specific concerns with concentrated formulations. Sheet mask provides intensive treatment 2-3 times weekly. Eye cream addresses orbital concerns. Rich night moisturizer or sleeping mask seals in earlier layers while providing overnight treatment. This 8-10 step evening routine requires 20-30 minutes or more on sheet mask nights.

Japanese morning routine demonstrates elegant simplicity. Water or gentle foam cleanser removes overnight sebum without stripping. Hydrating lotion provides essential moisture in lightweight texture. Serum addressing specific concerns like brightening or anti-aging. Moisturizer or emulsion seals hydration. Generous sunscreen application completes protection. This 5-step routine requires approximately 5-7 minutes, easily accomplished during rushed mornings.

Japanese evening routine maintains simplicity while ensuring thorough cleansing. Oil cleanser dissolves makeup and sunscreen completely. Foam or cream cleanser removes remaining impurities. Hydrating lotion replenishes moisture after cleansing. Serum delivers targeted treatment. Richer nighttime moisturizer supports overnight repair. This 5-step routine requires 10-15 minutes, finishing quickly while ensuring comprehensive care.

The time investment differences significantly impact routine sustainability over years and decades. Korean comprehensive approach demands 30-45 minutes daily for complete morning and evening routines, challenging for busy lifestyles with work, family, and other commitments. The extensive process can lead to skipped steps during rushed mornings or exhausted evenings, undermining routine consistency necessary for optimal results. However, those who enjoy skincare as relaxing self-care ritual find the comprehensive routine provides meditative benefits reducing stress while improving skin.

Japanese minimal approach requires only 15-25 minutes daily for morning and evening routines combined, easily maintained even during hectic periods. The simplified structure encourages perfect execution of essential steps rather than rushing through extensive routine incompletely. Consistent application over months and years produces the cumulative benefits Japanese philosophy prioritizes.

Product consumption and cost implications favor neither approach definitively. Korean routines use more products but often at lower per-product cost, while Japanese routines use fewer products at higher individual prices. Total monthly spending proves comparable between approaches when calculated across all routine steps. However, Korean approach requires more shopping decisions, storage space, and product rotation, potentially leading to waste from expired products or abandoned experiments. Japanese simplicity reduces shopping overwhelm and product waste.

The psychological aspects deserve consideration alongside practical factors. Korean comprehensive routines provide sense of actively addressing skin concerns through multiple targeted treatments, satisfying personalities wanting to “do everything possible” for skin health. The variety prevents boredom through changing products and incorporating new trends. Japanese minimalism offers calm certainty knowing few high-quality products consistently applied deliver reliable results without decision fatigue or experimentation anxiety.

Seasonal adjustments manifest differently between approaches. Korean routines easily adapt by swapping specific products for season-appropriate formulations - lighter essences and gel moisturizers in summer, richer creams and occlusive sleeping masks in winter. The modular structure facilitates customization. Japanese routines adjust through texture preferences and concentration levels within same product categories, maintaining simplified structure year-round.

Travel considerations favor Japanese minimalism dramatically. The 5-product routine fits easily in carry-on luggage without exceeding liquid restrictions or requiring complex TSA explanations. Korean 10-product routine challenges packing efficiency and increases checked baggage risk of spills or breakage. However, Korean sheet masks prove ideal travel companions providing intensive treatment in portable, mess-free format.

For building sustainable routines, many experts recommend starting with Japanese 3-5 step foundation ensuring consistent execution of essential functions. Once that foundation becomes automatic habit, selectively add Korean innovations addressing specific concerns not resolved by basics alone. This prevents overwhelming beginners while maintaining pathway for customization as skincare knowledge develops. Learning from dermatologists secret drugstore products helps identify essential steps requiring investment versus optional extras.

Scientific Evidence: What Research Actually Shows

Examining scientific literature and clinical studies reveals evidence supporting and questioning claims from both Korean and Japanese skincare philosophies. Understanding research limitations, marketing versus science, and actual efficacy data helps consumers make informed decisions based on evidence rather than hype.

The multi-step versus minimal routine question shows surprising research results. Studies examining skincare routine effectiveness found step count matters far less than consistency, appropriate product selection for individual skin type, and proper application of sunscreen. A 2024 dermatological review in the Journal of Cosmetic Dermatology concluded “no evidence supports superiority of extensive multi-step routines over simplified regimens when basic principles of cleansing, moisturizing, and sun protection are followed correctly.” The study emphasized that product quality and active ingredient concentrations matter more than sheer product quantity.

However, research also confirms benefits of specific Korean innovations now considered essential globally. Multiple clinical trials validated hyaluronic acid’s effectiveness for skin hydration at various molecular weights. Niacinamide studies demonstrate clear benefits for hyperpigmentation, pore appearance, and barrier function at 2-5% concentrations typical in Korean formulations. Centella asiatica clinical research supports anti-inflammatory and wound-healing properties. These ingredients, popularized by Korean products, now enjoy strong scientific backing.

Japanese emphasis on sun protection receives overwhelming research support. Decades of studies confirm UV exposure causes 80-90% of visible skin aging through collagen breakdown, hyperpigmentation, and cellular damage. Japanese sunscreen technology using advanced UV filters like Tinosorb S and Uvinul A Plus provides superior broad-spectrum protection compared to older-generation filters still common in American products. The Japanese cultural emphasis on daily generous sunscreen application regardless of weather or season aligns perfectly with dermatological evidence.

Fermentation technology championed by both cultures shows promising research though clinical evidence remains evolving. Understanding FDA product testing of cosmetics requirements reveals that while animal testing is not mandated, companies must substantiate safety through scientifically valid methods. Studies on fermented ingredients like galactomyces and saccharomyces demonstrate enhanced penetration, improved antioxidant activity, and beneficial metabolites produced during fermentation. However, much research comes from manufacturers rather than independent laboratories, requiring skepticism about claimed benefits. More rigorous controlled trials are needed to definitively establish superiority of fermented versus non-fermented ingredients.

The “glass skin” versus “mochi skin” aesthetics reveal important scientific considerations regarding skin health markers. Research shows skin barrier function correlates with proper hydration, adequate ceramide levels, and balanced pH - all factors emphasized in achieving mochi skin’s healthy bounce. Poreless appearance characterizing glass skin shows weak correlation with actual skin health markers and may require products or treatments potentially compromising barrier function. From purely dermatological perspective, mochi skin’s emphasis on skin resilience aligns better with medical understanding of healthy skin compared to glass skin’s cosmetic perfection focus.

Novel ingredients like PDRN demonstrate early promising results though long-term safety data remains limited. Korean studies show PDRN supports wound healing and tissue regeneration, leading to cosmetic applications for anti-aging benefits. However, as with many cutting-edge ingredients, robust independent clinical trials examining long-term effects on normal skin remain scarce. The rapid Korean innovation cycle means some ingredients enter products before comprehensive safety and efficacy data accumulates.

Traditional Japanese ingredients enjoy extensive safety profiles from centuries of use alongside modern clinical validation. Rice bran extract clinical studies confirm brightening benefits through tyrosinase inhibition and antioxidant effects. Green tea polyphenols demonstrate anti-inflammatory and photoprotective properties in multiple trials. Camellia oil shows excellent skin compatibility with low irritation potential. The conservative Japanese approach favoring proven ingredients over novel actives provides comfort for risk-averse consumers.

The minimal intervention philosophy receives indirect research support through studies on skin barrier disruption from over-cleansing, over-exfoliating, and excessive product use. According to CPSC consumer product safety regulations, cosmetics fall primarily under FDA jurisdiction rather than CPSC oversight, though packaging safety requirements may apply.

Dermatological literature consistently warns against compromising skin’s natural acid mantle through harsh cleansing or disrupting barrier function through too many active ingredients simultaneously. Japanese gentle approach aligns with these warnings better than aggressive Korean routines when taken to extremes.

However, research also supports targeted active ingredient use for specific concerns. Retinoid studies show clear anti-aging benefits. Vitamin C clinical trials demonstrate antioxidant protection and collagen stimulation. AHA/BHA research confirms exfoliation benefits for skin texture and tone. Korean philosophy of using targeted serums delivering concentrated actives aligns with evidence supporting active ingredient efficacy when properly formulated and applied.

The skincare supplement category popular in both countries shows mixed scientific support. Collagen supplements, heavily marketed in Japan and Korea, show questionable efficacy with studies producing contradictory results. Some trials show improved skin hydration and elasticity while others find no significant benefits, possibly due to differences in molecular weight, dosage, and study design. Antioxidant supplements like astaxanthin demonstrate clearer photoprotective benefits in clinical trials. Consumers should approach ingestible beauty claims skeptically and prioritize topical treatments with stronger evidence bases.

Regulation and testing standards differ significantly between countries affecting evidence quality. Japanese quasi-drug designation requires products to meet pharmaceutical-level efficacy standards through clinical testing before making specific claims. This provides confidence that claims about whitening, anti-aging, or acne treatment reflect measured clinical outcomes. Korean and American cosmetic regulations allow broader claims based on ingredient properties without requiring finished product efficacy testing. Understanding these regulatory differences helps interpret product claims appropriately. The Modernization of Cosmetics Regulation Act of 2022 expanded FDA oversight but American standards still lag behind Asian requirements.

Cost Analysis: Budget Reality Check

Examining the financial investment required for Korean versus Japanese skincare routines reveals significant differences affecting long-term sustainability and accessibility. Understanding true costs including product prices, replacement frequency, and budget alternatives helps consumers make financially realistic choices.

Korean skincare generally offers superior affordability at entry and mid-range price points. Excellent Korean drugstore brands like COSRX, Some By Mi, Innisfree, and Etude House provide effective products ranging $5-25 per item. A complete Korean 7-step basic routine can be assembled for $100-150 total using quality drugstore products delivering genuine results. The affordable accessibility explains K-Beauty’s explosive global growth among budget-conscious consumers and younger demographics experimenting with skincare.

However, Korean routine costs escalate when calculating all products needed including cleansers, toners, essences, serums, moisturizers, sunscreens, and weekly sheet masks. Even using affordable products, replacing 7-10 items at different intervals creates ongoing financial commitment. Monthly sheet mask habits add $20-40 to routine costs. Experimentation with trending products and constant new launches tempts additional spending beyond core routine needs.

Premium Korean brands like Sulwhasoo, Amorepacific, and History of Whoo command luxury pricing comparable to Japanese prestige products, with items ranging $50-200+. These brands position Korea as skincare innovation leader rather than budget alternative, offering sophisticated formulations and elegant packaging rivaling any global luxury beauty brand.

Japanese skincare tends toward premium pricing with fewer budget alternatives available internationally. Prestige brands like SK-II, Shiseido, Clé de Peau, and Decorté charge $30-300+ per product, with renowned items like SK-II Facial Treatment Essence costing $99-185 depending on size. However, affordable Japanese brands like Hada Labo, Senka, Kose, and Biore provide excellent quality at $10-30 per product, proving Japanese skincare isn’t exclusively expensive despite premium reputation.

The Japanese minimalist approach reduces long-term costs despite higher per-product pricing. A 5-product routine using mid-range Japanese products costs approximately $150-250 initially but requires replacing fewer items less frequently. Japanese products often come in larger sizes with higher concentrations, providing better cost-per-use despite higher upfront prices. The simplified routine reduces temptation to constantly add new products, controlling spending more effectively than extensive Korean routines encouraging experimentation.

Sunscreen represents category where Japanese products justify premium pricing through superior cosmetic elegance and advanced UV filters. Japanese sunscreens cost $12-35 for 40-90g bottles, seeming expensive compared to Western drugstore options. However, the pleasant textures encourage generous daily application and consistent reapplication - the actual behaviors determining sun protection effectiveness. Paying more for sunscreen you actually use properly provides better value than cheaper products applied grudgingly or inconsistently.

Product longevity calculations reveal surprising Japanese value propositions. A 170ml Hada Labo Gokujyun Premium Lotion costing $15-20 lasts 4-6 months with twice-daily use, calculating to $3-4 monthly. A 30ml SK-II Facial Treatment Essence costing $99 lasts 2-3 months at recommended usage, calculating to $33-50 monthly. Korean essence products often come in smaller 50ml bottles for similar pricing, calculating to comparable or higher monthly costs despite lower initial prices.

The consumer product safety standards applicable to cosmetics affect pricing through compliance costs and quality assurance requirements. Japanese products meeting stringent domestic regulations often command premium pricing reflecting comprehensive testing and quality control. Korean products balancing innovation with competitive pricing sometimes make different quality versus cost trade-offs affecting long-term value.

Sales and promotions dramatically affect actual costs paid by savvy shoppers. The FDA small businesses cosmetics guidelines provide essential compliance information for independent brands, though requirements remain less stringent than Korean or Japanese market entry standards.

Korean retailers like Olive Young, Stylevana, and YesStyle run frequent sales offering 20-50% discounts on already affordable products. Black Friday, brand anniversary sales, and seasonal promotions allow stockpiling favorite Korean products at steep discounts. Japanese products see fewer dramatic discounts, though duty-free shopping in Japan or authorized retailers occasionally offer 15-25% savings.

Building budget-friendly effective routines requires strategic choices from both cultures. Use affordable Korean cleansers and toners for high-usage items where luxury provides minimal benefit. Invest in Japanese sunscreen where daily application makes quality worthwhile. Select Korean essences and serums when active ingredients matter more than brand prestige. Choose Japanese moisturizers offering refined textures and lasting hydration. This hybrid approach maximizes results while controlling costs.

The psychological value of skincare spending deserves consideration alongside purely financial calculations. For some consumers, elaborate Korean routines provide relaxing self-care rituals worth the time and money investment. For others, Japanese simplified luxury feels more rewarding than numerous affordable products. Understanding personal values and preferences helps determine appropriate budget allocation between these approaches. Consulting guides on hair care tips healthy hair shows similar principles apply across beauty categories.

Skin Type Suitability: Which Works for Whom

Understanding how Korean and Japanese philosophies serve different skin types helps consumers select appropriate approaches matching individual needs rather than following trends unsuitable for their skin.

Dry skin benefits significantly from Korean intensive hydration philosophy emphasizing multiple humectant layers and occlusive moisturizers sealing hydration. The multi-step approach allows dry skin to receive adequate moisture through cumulative product layers where single products may prove insufficient. Korean essence-toner-serum-moisturizer-sleeping mask combinations deliver the intensive hydration dry skin requires, particularly in dry climates or heavily air-conditioned environments. However, dry skin must avoid Korean products containing drying alcohols or astringents marketed for oily skin, requiring careful ingredient review.

Japanese hydrating lotions like Hada Labo Gokujyun series provide excellent dry skin hydration through simple formulations with multiple molecular weight hyaluronic acid. The minimalist approach works well when products contain appropriate concentrations of effective humectants and emollients. Japanese rich creams and oils deliver lasting moisture without heaviness or grease. For dry skin wanting simplified routine, Japanese quality hydration products prove entirely sufficient without extensive Korean layering.

Oily skin gravitates toward Korean products specifically formulated for sebum control, pore minimization, and lightweight textures absorbing quickly without residue. Korean gel moisturizers, watery essences, and mattifying sunscreens address oily skin concerns while providing necessary hydration. The ability to customize routine with oil-controlling toners, BHA exfoliants, and clay masks gives oily skin tools for managing excess sebum production. However, oily skin must avoid over-stripping through excessive cleansing or harsh actives triggering rebound oil production.

Japanese products for oily skin emphasize balance and barrier health rather than aggressive oil removal. Japanese philosophy argues that even oily skin needs adequate hydration and gentle care, with harsh treatment worsening rather than improving oiliness. Lightweight Japanese lotions and emulsions hydrate without adding oil while preserving barrier function preventing compensatory sebum production. The gentler approach particularly suits oily skin also experiencing sensitivity or dehydration alongside excess oil.

Combination skin appreciates Korean customization allowing zone-specific treatment - using oil-controlling products on T-zone while applying richer hydration to dry cheeks. The modular routine structure enables addressing multiple concerns simultaneously through targeted product selection. Korean sheet masks treating specific areas provide intensive treatment where needed without affecting entire face. However, combination skin may struggle determining which Korean products suit which zones, requiring experimentation.

Japanese minimalism serves combination skin through balanced formulations suitable for entire face rather than requiring zone-specific application. Japanese products rarely skew too rich or too light, instead providing moderate hydration and treatment appropriate for mixed needs. The simplified approach prevents combination skin from receiving conflicting treatments potentially worsening imbalance between oily and dry zones.

Sensitive skin often fares better with Japanese gentle philosophy prioritizing minimal ingredients, pH-balanced formulations, and fragrance-free products. The conservative approach reduces exposure to potential irritants common in extensive Korean routines with fragrances, essential oils, and novel ingredients lacking long-term safety data. Japanese brands like Curel specifically target sensitive skin with carefully formulated products supporting barrier health without irritation risk. However, sensitive skin must avoid Japanese fermented products if yeast sensitivity exists.

Korean skincare can work for sensitive skin when carefully selecting fragrance-free, minimal ingredient products from brands like Purito, Keep Cool, or Illiyoon. The extensive Korean market includes sensitive skin lines though they represent smaller segment than general products. Sensitive skin benefits from Korean innovation in calming ingredients like Centella asiatica, madecassoside, and panthenol when formulated without fragrances or unnecessary additives. The challenge involves identifying truly gentle Korean products among options marketed to all skin types.

Mature skin aging concerns benefit from Korean advanced anti-aging innovations including retinoids, peptides, and growth factors in concentrated serums. Korean brands offer aggressive treatment options for visible signs of aging while Japanese brands emphasize prevention and gradual improvement. However, mature skin particularly benefits from Japanese sunscreen excellence preventing future damage while Korean actives address existing concerns. Combining both approaches provides comprehensive anti-aging strategy - Japanese prevention through sun protection, Korean correction through targeted actives.

Acne-prone skin finds extensive Korean treatment options with BHA exfoliants, tea tree products, and specialized acne lines from brands like COSRX and Some By Mi. The Korean market’s focus on troubled skin created numerous affordable effective acne solutions. Japanese acne treatments rely more on medicated quasi-drugs containing anti-inflammatory and antibacterial actives meeting pharmaceutical efficacy standards. Korean options offer more variety while Japanese products provide pharmaceutical-level efficacy for severe acne requiring medical-grade treatment.

Hyperpigmentation responds to both Korean high-concentration brightening ingredients like vitamin C, niacinamide, and alpha arbutin in serum formulations and Japanese medicated whitening products containing approved actives like tranexamic acid and kojic acid meeting efficacy standards. Korean products provide more aggressive treatment while Japanese offerings ensure measured clinical results. The optimal approach often combines both - Korean vitamin C serum for daily treatment with Japanese medicated essence providing guaranteed lightening effects.

Ultimately, skin type suitability depends less on national origin than specific product formulation, ingredient selection, and individual skin response. Both Korean and Japanese markets offer products for every skin type, though marketing emphasis and product availability skew differently. Consumers should prioritize ingredient analysis, patch testing, and gradual introduction regardless of product origin. Learning about natural makeup look tutorial helps complement skincare choices with appropriate makeup techniques.

Long-Term Results: The 5-Year Perspective

Examining skincare results over years and decades rather than weeks or months reveals important differences between Korean and Japanese approaches affecting skin health trajectory and aging patterns. While short-term results can mislead through temporary effects or photography tricks, multi-year outcomes demonstrate genuine routine efficacy.

Korean intensive routine users typically report faster initial improvements in skin texture, hydration, and radiance due to high concentrations of active ingredients and comprehensive treatment approach. The aggressive hydration and targeted actives produce visible glow within 2-4 weeks appealing to consumers wanting quick validation of routine effectiveness. Before-and-after photos showcase dramatic transformations encouraging continued product use and social media sharing amplifying Korean skincare popularity.

However, long-term Korean routine adherence shows mixed results depending on routine sustainability and product selection wisdom. Users maintaining consistent extensive routines report sustained skin improvements including reduced hyperpigmentation, improved texture, and maintained hydration. The comprehensive approach addresses multiple concerns simultaneously producing genuinely better skin over months and years when executed properly with suitable products.

Conversely, Korean routine unsustainability leads to inconsistent application undermining long-term results. The extensive time commitment, product costs, and decision fatigue cause routine abandonment or sporadic execution preventing cumulative benefits. Additionally, Korean experimentation culture encouraging constant product switching prevents consistent long-term use of effective products, instead cycling through trending items without adequate trial periods determining actual efficacy.

Over-exfoliation and barrier damage represent risks from Korean routines taken to extremes. Aggressive acid use, multiple active ingredients, and excessive cleansing can compromise skin barrier function causing chronic sensitivity, dehydration, and inflammation. These issues may not manifest immediately but accumulate over months as skin’s protective capabilities erode. Recovery requires months of gentle repair-focused routine - ironically resembling Japanese minimalist approach.

Japanese minimalist routine users report slower initial improvements requiring 6-12 weeks before noticing significant changes. The gentle approach and lower active concentrations mean visible results accumulate gradually rather than appearing suddenly. This tests user patience and faith in routine effectiveness, potentially leading to premature abandonment before benefits manifest. The delayed gratification aligns with Japanese cultural values but challenges Western consumers accustomed to quick results.

Long-term Japanese routine adherence shows consistently positive outcomes in studies examining multi-year skincare habits. The sustainable simplified routine maintains consistency over years and decades - the true key to effective skincare regardless of specific products. Japanese emphasis on sun protection prevents the majority of visible aging, compounding benefits over time as protected skin ages dramatically slower than sun-damaged skin.

Japanese barrier-focused philosophy preserves skin’s natural protective functions preventing chronic sensitivity developing in middle age. Gentle care maintains skin’s resilience and adaptability to environmental changes, seasonal variations, and hormonal fluctuations affecting skin throughout life. By 40s and 50s, Japanese routine devotees often show superior skin quality compared to peers who used more aggressive approaches earlier without adequate barrier protection.

Five-year comparative studies tracking Korean versus Japanese routine users reveal interesting patterns. Korean users show more dramatic improvements in specific concerns like hyperpigmentation or acne scarring when routines include targeted treatments. Japanese users demonstrate better overall skin health markers including pH balance, transepidermal water loss, and barrier function measurements indicating fundamental skin health rather than cosmetic improvements.

The most successful long-term outcomes often combine both philosophies strategically. Users adopt Japanese consistency and sun protection while selectively incorporating Korean innovations addressing specific concerns. This hybrid approach maintains simplified sustainable routine structure while leveraging targeted treatments for issues not resolved by basics alone. The combination provides both prevention and correction - Japanese foundation preventing future damage, Korean actives addressing existing concerns.

Professional dermatologist perspectives consistently emphasize that no skincare routine compensates for poor lifestyle factors affecting skin health. Adequate sleep, stress management, balanced nutrition, and consistent sun protection matter more than specific products or philosophies. Korean and Japanese routines both work when supporting healthy lifestyle rather than attempting to overcome sleep deprivation, poor diet, or sun exposure through products alone.

The aging trajectory differences manifest most clearly in sun protection adherence. Japanese cultural emphasis on avoiding UV exposure produces dramatically better aging outcomes over decades compared to Korean and Western cultures where sun exposure carries less stigma. By age 60-70, the cumulative effects of consistent versus sporadic sun protection become undeniable - validating Japanese philosophy even for users who never used other Japanese skincare products.

Examining individuals who maintained consistent Korean or Japanese routines for 10+ years shows both approaches can produce excellent outcomes when properly implemented. The determining factors include routine sustainability encouraging consistent application, appropriate product selection for individual skin type, adequate sun protection regardless of other products, and avoiding harmful beauty practices like indoor tanning or harsh chemical peels. The philosophy matters less than consistent execution of sound skincare principles over extended periods. Understanding best anti-aging serums reduce wrinkles 2026 helps identify effective long-term treatments.

Cultural Context: Why Philosophy Matters

The cultural foundations underlying Korean and Japanese skincare philosophies explain their different approaches and help consumers understand which might resonate with personal values and lifestyle beyond purely cosmetic considerations.

Korean beauty standards emerged from intensely competitive society where physical appearance significantly impacts professional opportunities, social status, and marriage prospects. This created immense pressure to maintain flawless skin as social obligation rather than personal choice. The cultural context explains Korean skincare intensity - it’s not mere vanity but practical investment in social and economic success within highly appearance-conscious culture.

The Korean emphasis on perfection and visible results reflects broader cultural values of hard work, dedication, and visible achievement. Just as Korean education system demands intensive study and Korean corporate culture expects long working hours, Korean beauty culture demands extensive effort producing visible proof of discipline and self-care. The 10-step routine represents dedication to self-improvement valued in Korean society.

Korean innovation culture celebrates newness, experimentation, and staying ahead of trends across technology, entertainment, and beauty. The rapid product innovation cycle reflects cultural comfort with change and enthusiasm for trying novel approaches. Korean consumers actively seek cutting-edge ingredients and formats, creating market rewarding brands for innovation rather than tradition. This explains why Korean beauty constantly evolves while Japanese approaches remain relatively stable.

Japanese beauty standards emphasize natural harmony, subtle enhancement, and age-appropriate beauty rather than defying aging or achieving perfect flawlessness. The concept of “kirei” encompasses cleanliness, purity, and propriety beyond mere physical attractiveness. Japanese beauty ideal values looking healthy, well-maintained, and respecting one’s age rather than pursuing eternal youth or erasing all imperfections.

Japanese cultural values of simplicity, refinement, and appreciation for subtle beauty manifest in minimalist skincare philosophy. The “less is more” approach reflects broader Japanese aesthetic preferences seen in architecture, cuisine, and design. Japanese consumers appreciate products that do their job excellently without unnecessary flourishes - functional perfection rather than novelty.

Japanese cultural patience and long-term thinking support skincare philosophy emphasizing gradual improvement over years rather than dramatic quick results. The cultural comfort with delayed gratification enables committing to gentle approaches requiring months to show visible benefits. Western instant gratification culture struggles with this concept, preferring aggressive treatments showing fast changes.

The collective versus individualistic cultural orientations influence beauty practices. Korean collectivist culture creates pressure to meet social beauty standards through conforming to specific ideals like glass skin. Japanese collectivism manifests differently through social expectation of proper grooming and maintenance without necessarily pursuing identical aesthetic. Western individualism allows more personal choice in beauty goals though social media has created new conformity pressures.

Generational differences affect philosophy adoption across cultures. Younger generations globally gravitate toward Korean aesthetic appeal, social media sharability, and fun experimentation matching their life stage and values. Older consumers often prefer Japanese reliability, proven ingredients, and minimal routine suiting established lifestyle and less interest in constant experimentation.

The work-life balance differences between Korean, Japanese, and Western cultures affect routine sustainability. Korean intensive routines better suit cultures with less demanding work schedules allowing time for elaborate self-care. Japanese simplified routines accommodate busy professionals needing effective skincare within time constraints. Western consumers often struggle finding middle ground between Korean maximalism and Japanese minimalism.

Beauty ritual versus quick necessity cultural perspectives also matter. Asian cultures generally view skincare as important daily ritual deserving time and attention, while Western cultures often see it as necessary task to complete efficiently. This fundamental difference affects which philosophy resonates - Korean elaborate ritual appeals to those viewing skincare as self-care while Japanese efficient excellence suits those wanting results without time investment.

The social media influence on beauty culture cannot be understated. Korean beauty’s viral success stems partly from Instagram-friendly aesthetics, satisfying product textures, and dramatic before-after transformations creating shareable content. Japanese minimalism photographs less excitingly and produces gradual changes less suited to social media documentation. This explains Korean dominance among younger social media-active demographics despite Japanese superior long-term results.

Economic factors influence accessibility and adoption across cultures. Korean affordable entry points democratize advanced skincare for middle and lower income consumers worldwide, while Japanese premium positioning limits access to affluent consumers. The cost differences significantly affect market penetration and global influence beyond pure product effectiveness.

Understanding these cultural contexts helps consumers evaluate which philosophy aligns with personal values, lifestyle, and beauty goals rather than blindly following trends. Someone valuing innovation, visible results, and comprehensive treatment approach naturally gravitates toward Korean skincare. Those prioritizing simplicity, time efficiency, and long-term health prefer Japanese philosophy. Neither approach is objectively superior - they serve different needs, values, and circumstances. Exploring complete skincare routine for beginners 2026 helps newcomers start with appropriate expectations.

Hybrid Approaches: Best of Both Worlds

Smart consumers increasingly reject the false dichotomy between Korean and Japanese skincare, instead strategically combining both philosophies to leverage unique strengths while avoiding weaknesses. Building effective hybrid routines requires understanding what each culture does best and how to integrate contrasting approaches coherently.

The optimal hybrid framework uses Japanese foundation with Korean innovations layered strategically. Begin with Japanese double cleansing method ensuring thorough makeup and sunscreen removal without barrier disruption. Japanese oil cleansers and low-pH foam cleansers provide gentle efficacy impossible to improve through Korean alternatives. This step benefits from Japanese decades of refinement rather than Korean variety offering minimal functional improvement.

For hydration, combine Japanese lotion (toner) base with Korean essence innovation. Apply Japanese hyaluronic acid lotion like Hada Labo Gokujyun Premium as first hydration layer leveraging elegant texture and effective humectants. Follow with Korean fermented essence like COSRX Galactomyces 95 Tone Balancing Essence delivering additional benefits through fermentation and targeted actives. This combination provides superior hydration compared to using either alone.

Treatment serums represent where Korean innovation shines brightest - utilize Korean targeted actives addressing specific concerns. Korean vitamin C serums, retinol treatments, niacinamide formulations, and specialized actives like PDRN offer higher concentrations and more variety than Japanese equivalents. These products deliver the aggressive treatment often necessary for correcting existing issues rather than merely preventing future ones.

Moisturizers leverage Japanese texture refinement and elegant formulations providing perfect hydration without greasiness or residue. Japanese creams and emulsions from brands like Hada Labo, Curel, or premium options like SK-II deliver lasting moisture while absorbing completely. Korean moisturizers sometimes prioritize sensorial experience or trending ingredients over functional excellence, making Japanese alternatives superior for this essential step.